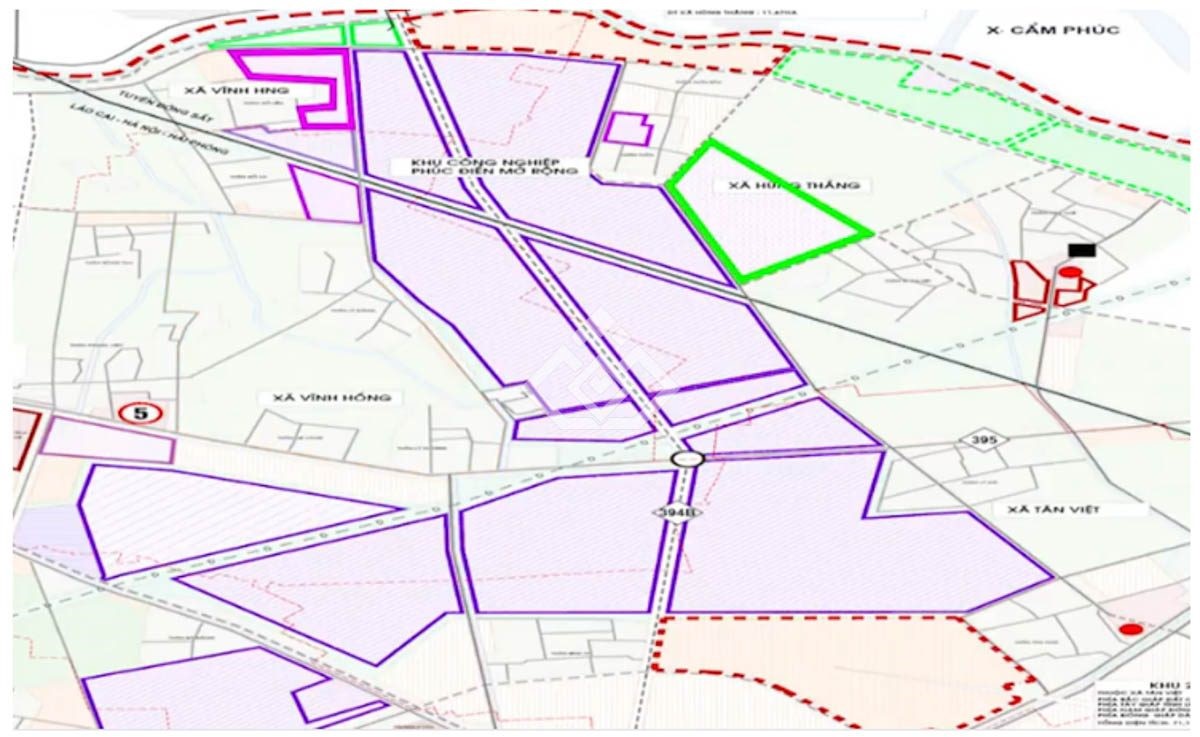

Phuc Dien Industrial Park expansion project is located in Vinh Hong, Vinh Hung and Hung Thang communes, Binh Giang district, Hai Duong province

On March 19, 2021, the expanded Phuc Dien Industrial Park was officially approved by the Prime Minister for investment policy according to Decision No. 398/QD-TTg with the investor being Trung Quy Investment Joint Stock Company – Bac Ninh and the expected investment capital is 1,800 billion VND. The project has an operating term of 50 years (until March 19, 2071) and has an expected construction progress of 3 years.